Is the Bull Market Over

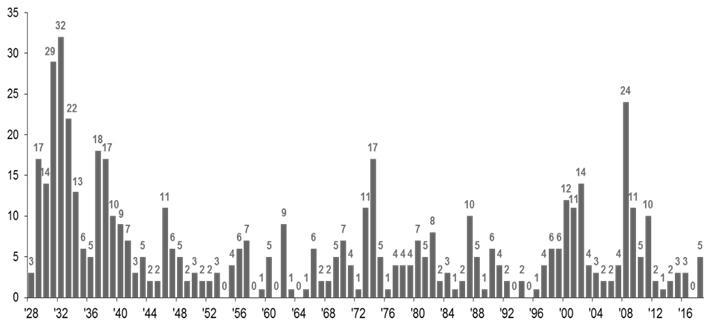

Recently the stock market has pulled back in all world markets and especially outside the United States. However, our S&P 500 has seen greater fluctuations this year than we have experience since 2011. Especially on the heals of 2017 when we had zero 5% declines in the year (see graph below).

One reason is the Federal Reserves’ continued unwinding of the greatest financial experiment seen in our lifetime due to the 2008 Great Recession. Therefore, we are not surprised by risky assets (stocks) having greater fluctuations in prices.

Moderate pullbacks happen frequently, even in normal times.

The number of 5% pullbacks the S&P 500 experienced per year.

Source: JP Morgan – does not include the reinvestment of dividends. Date as of 10/24/2018.

Times like these require patience and perspective. In the past 20 years, the 10 best days have occurred within two weeks of the 10 worst days. In 2015, the best day for the S&P 500 (August 26) occurred two days after the worst day (August 24), according to JP Morgan. Jumping out of the market because the TV news is bleak is often the wrong decision. Especially in a healthy and growing economy like ours.

Don’t hesitate to contact our office with you have any questions or concerns about your allocation. We are monitoring your accounts, investments and the economy on a daily basis. Join me in following your plan and riding the trend as a long-term investor.