Groaning at the Speed of Interest Rate Increases

Federal Reserve Board Chairman, Jerome Powell, commented last Wednesday, during the Atlantic Festival at a session moderated by Judy Woodruff of the PBS News Hour saying, "The really extremely accommodative low interest rates that we needed when the economy was quite weak, we don't need those anymore."

He added, "Interest rates are still accommodative, but we're gradually moving to a place where they will be neutral. We may go past neutral, but we're a long way from neutral at this point." [my emphasis added.]

The reaction of the markets was swift and dramatic. The 10-year Treasury note rose from 3.06% on Tuesday to 3.23% on Friday (increasing by 5.55%), its highest yield since 2011. Since then and through yesterday, Wednesday, October 10, the S&P 500 has fallen by -5.01%.

So why did the market react so dramatically? While Michael was the real storm that blew threw at a rapid pace so have interest rates (measured by the 10-year US Treasury yield) gone up at a rapid pace. And it is not the increase but the pace of the increase that causes short-term market declines.

The much larger bond market needs quarterly and semi-annual coupons to pay out and repay investors for the rapid decreases in bond values. So, it is the pace of the change that is brutal and produces such sharp stock market declines.

I have never believed that long-term rates were being held down by recent slow growth or low foreign rates. I believe they have been held down by the Fed's policy of low short-term rates and the market’s belief that the Fed would hold them low. That has now changed.

And, yes, higher interest rates do reduce the fair value of equities. But even with current earnings, it would take a 3.7% 10-year yield to make current equity values "fair." With earnings likely to grow 20%+ this year and 10%+ next year, the market can handle higher interest rates and continue to rise.

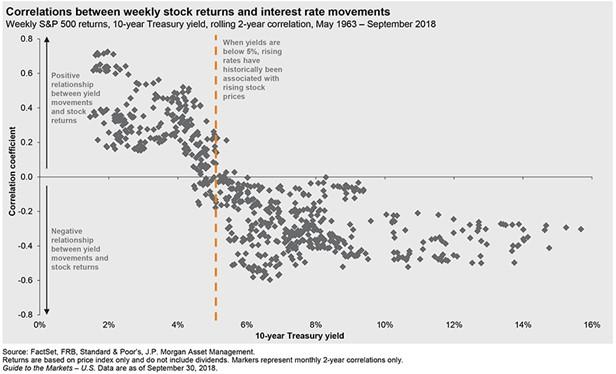

Higher rates are coming, but that doesn't mark the end of the recovery or the bull market. Consider the J P Morgan graphic on the following page; it shows the correlation of interest rates (10-yr Treasury Yield) to the S&P 500 two-year returns. The grey dots are consistently above zero when the 10-yr Treasury Yield is below 4.4%. Until the current 3.15% 10-yr Treasury Yield is nearby to that number (increasing 40% above its current 3.15% rate), interest rates will likely give us short term fluctuations in the S&P 500, while the bull rallies.

Thank you for thinking like a long-term investor!

Derrell Crimm, CFP®