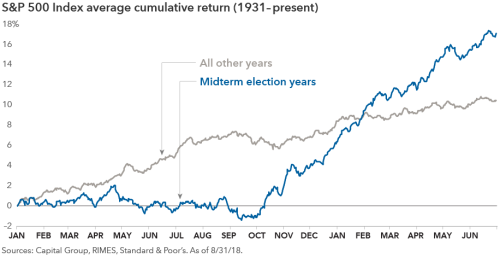

Market returns tend to be muted until later in midterm years

Since markets rise over long periods, it makes sense that the price chart of an “average” year also would steadily increase. However, isolating just the midterm election years highlights that these periods are different than others. In such instances, markets tend to move sideways for most of the year, gaining little ground until shortly before the election.

The adage that markets don’t like uncertainty seems to apply here. Earlier in the year there is less certainty about the election’s outcome and its policy impact. But markets tend to rally when results are easier to predict in the weeks before an election and continue to rise after the polls close and winners are declared.

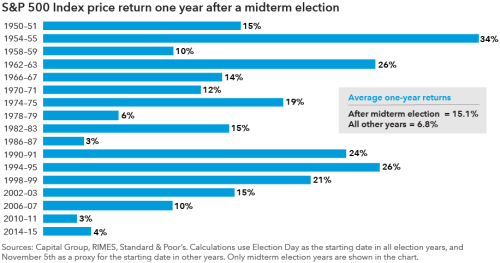

The silver lining for investors is that after such bouts of volatility, markets tend to rebound strongly in subsequent months.